A massive opportunity is available in transformer stocks in India, which involves in power sector value chain. As country moving to become a manufacturing hub, there is huge requirement for power and the government is already investing to expand the capacities to meet the raising demand.

Again power sector is evolving as a big opportunity for the investors as a industry. The power sector involves multiple sub divisions such as cables, wires, switches, transformers, solar panels and many other ancillaries are there. Each and every sector giving big opportunities if you analyses.

If you observe entire power sector value chain involves three phases. One is power generation, power transmission and power distribution. So entire power sector value chain involves these three key phases, which we’ve been already discussed in our previous article in detail.

Power Generation: Power generation phase is the first phase in the power sector value chain, where the companies generates the power in different ways. Such as thermal power, hydro power, solar power and wind power. And the opportunity we’ve already played by choosing the powerful stocks from this segment. Do check it our here, if you have not gone through it.

Power Transmission: Power transmission is the second phase power sector value chain, which helps to transmit the power from generation phase to distribution phase, which plays a vital role in the entire power sector value chain. We found the opportunity here in this phase.

There is different companies working in different areas of the power transmission phase. The below are the various products involves in power transmission. You can find the best companies from the below different segments as there is big opportunity as there is lot of MNCs and domestic players, which are having technical edge and clear moat.

- Overhead Transmission Lines

- Subtransmission Lines

- Underground Transmission Lines

- Steu Up Transformers

- Step Down Transformers

- Air Break Switches

- Cables

- Poles

- Transformer Oils

- Insulators

- CTC Conductors

- Rectifiers

- Switch Gears

- Smart Transformers

Power Distribution: In the power distribution phase the DISCOMs will play major role, though there is private companies in some states such as TATA power, Adani power are the major players. But still state owned DISCOMs are dominant players.

What are the Transformers?

There is two types of transformers are there in the power sector, there are Step up transformers and step down transformers, which were very much important in both power generation and power transmission. Again there are two types of transformers such as air cooled tranformers and oil cooled transformers.

Though there is high usage of oil cooled transformers, but going ahead air cooled transformers will replace the same. And the companies are also working and spending on the same. Again there are single phase and three phase transformers are there. So this introduction would be helpful to understand the transformer stocks in India

Key growth drivers of transformer stocks in India:

1. Bharat needs high power generation capacities to meet the high demand as our country becoming manufacturing hub.

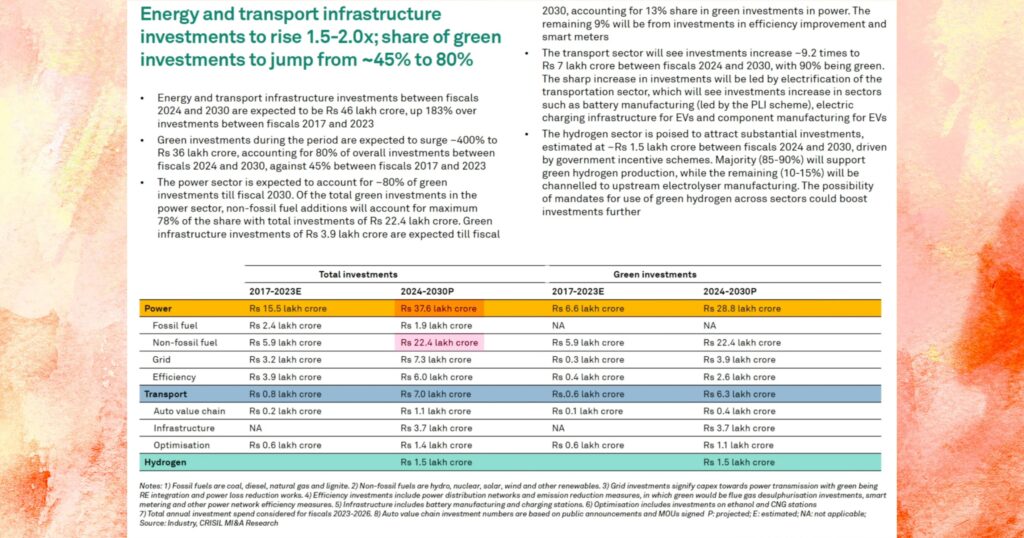

2. Bharat government is going to spend more than Rs. 37 Lakh crores to expand the power capacities.

3. There will be high usage of transormers as our nation focusing on green power, which needs double the transformers as it’s high volatile.

Key Risks involved in Transformer stocks in india:

1. Copper prices fluctuation as it’s the one raw material

2. Transformer oil prices depends on crude oil prices, so should track either impacting or not.

3. Special steel which uses in manufacturing. Should closely track as it’s margins killer.

4. Highly dependent on governments.

5. High capital intensive business

6. Relations with government will always gives the edge.

Best Transformer Stocks in India:

1. ABB, Hitachi and Siemens are the very good companies in this sector and they are the MNCs also. But they are trading in expensive valuations. If anyone don’t want to take risk and wants to play safe, then work on these companies for the better opportunity.

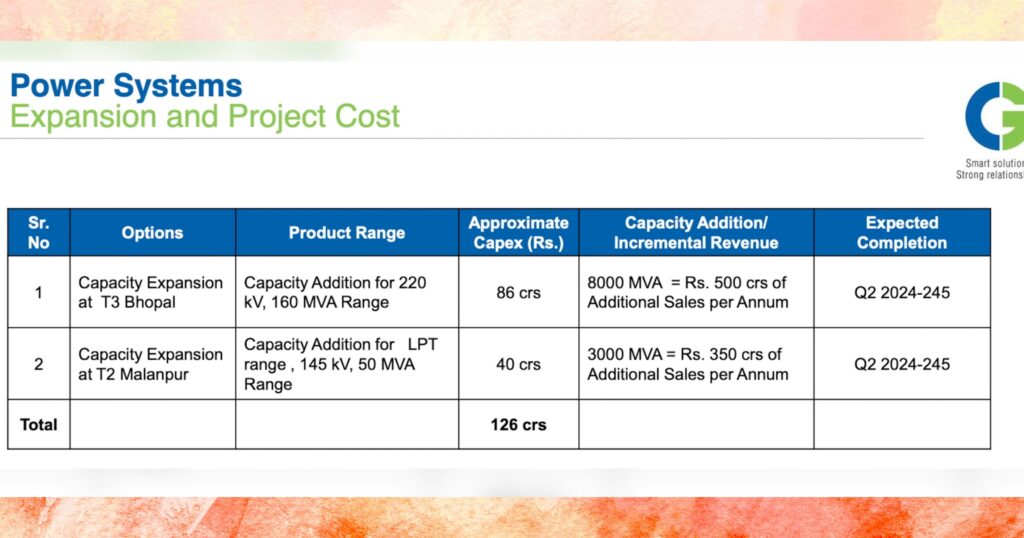

2. CG Power Solutions Ltd

After Tube investments acquisition of CG Power, the company completely transformed from loss making to profitable. This company works both on industrial systems and power systems. This company manufactures power transformers, distribution transformers and switch gears.

CG Power itself growing their revenues by 11%, PAT by 61%. The margins were improved from 4% to 14%, which is impressive. ROE is 66%, ROCE is 62% and the company is trading at 64 PE multiples.

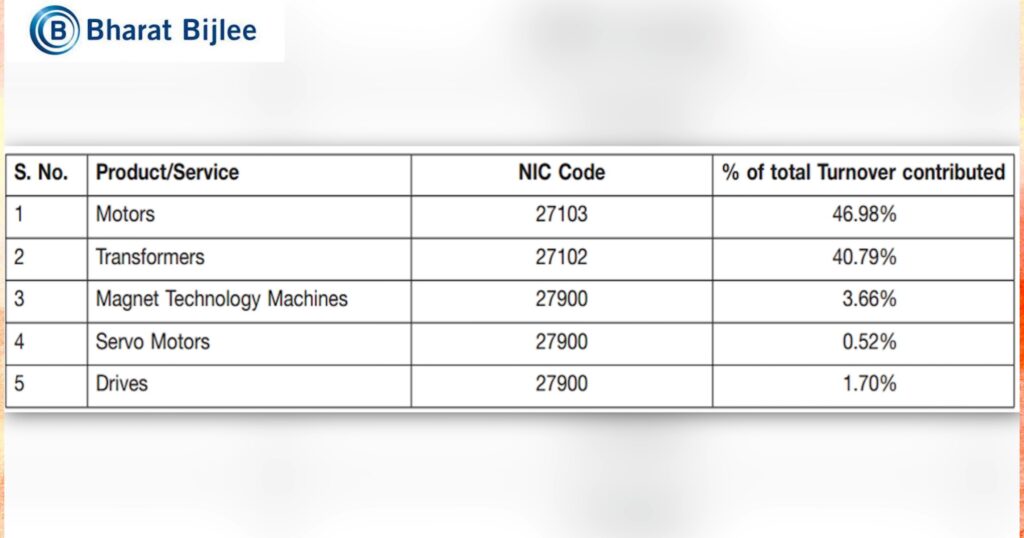

3. Bharat Bijlee Ltd

Bharat Bijlee works on power systems, industrial systems and industrial automation and magnet technology machines. This company manufactures power transformers, generator transformers and u-auxiliary transformers.

48% of revenues are coming from transformers. And they growing their revenues by 15%, PAT by 23%. ROE is 7% and the ROCE is 9% and the company is trading at 22 PE multiples.

4. Voltamp Transformers Ltd

Voltamp is also a transformer manufacturer, they are generating 100% of revenues from transformers only. If you look at their margins, which is 17%. This company is also expanding their capacities to manufacture switchgears also. And posted very good quarterly results.

5. Transformers & Rectifiers India Ltd

TRIL is buzzing stock as all you know. This company trading at expensive valuations and there is pledge in stake of promoters and also they have some disputes with GETCO. So do closely watch before investing as per risk appetite.

6. Shilchar Technologies Ltd

Shilchar is also generating revenues from exports which can cater the international demand also as it’s not only the india’s but also the global opportunity. Exports grown from 40% to 52%, where they had earning 48% from domestic market.

Apart from these companies there is lot of good companies to work on such as GE T&D, amba, Kirloskar Electric, Apar, Schneider electric, indo tech, star delta transformers, salzer electronics and RTS power corporation.

Conclusion:

As we discussed earlier it’s the global opportunity as entire world is moving to generate the power from non fossil fuels, where there is high demand for transformers and other products manufacturing companies, which we use in power transmission stage, which is very crucial phase. So do work on transformer stocks in india, where there is big opportunity to make multi fold returns.

Hope you all received the complete data about power value chain, which involves three important phases such as power generation, power transmission and power distribution. The current theme stocks are from power transmission and that to only transformers related. So you all got the complete information about the entire theme’s opportunities, risks and the stocks to play.

If you want you can also pick the stocks from the other product segments of power transmission phase, which very good for the long term investments as it’s turning into an global opportunity.

We’ve already made very good returns by playing power generation stocks in previous article, you can also check it here, which is short term opportunity and we clearly mentioned that as a short term opportunity.

Better avoid the power distribution stocks as there is state owned DISCOMs are the dominant players. Smart meter stocks such as genus power, HPL electric were delivered fantastic returns, as we mentioned very clearly in our twitter handle and clearly giver profit booking update after reaching 100% retunrs.

If you are a beginner to the stock market, don’t have proper knowledge in stock selection and how to do stocks and industry analysis, better follow our fundamental analysis articles to learn better about stock market from basics to advance by following fundamental analysis.

Note: don’t take it as buy or sell recommendation as it’s my purely personal opinion and here is my analysis on the particular segment. Add this to your analysis or if you don’t have any idea, please take an advice from your financial advisor as we are not SEBI registered.

Note: don’t take it as buy or sell recommendation as it’s my purely personal opinion and here is my analysis on the particular segment. Add this to your analysis or if you don’t have any idea, please take an advice from your financial advisor as we are not SEBI registered.