Today we are going to discusss about an interesting industry and it’s key stocks, where investors are not at all showing their interest, almost investors are ignoring these stocks. Even if you observe the count of investors are gradually decreasing. They’re Diagnostics Stocks.

Why these Diagnostics Stocks are falling?

- First time, when the crowd realized that the covid euphoria is down, investors started exiting.

- When online companies such as 1mg, Pharmeasy and netmeds made entry, people thought that this industry is going to disrupt by online companies. But still it’s not happening.

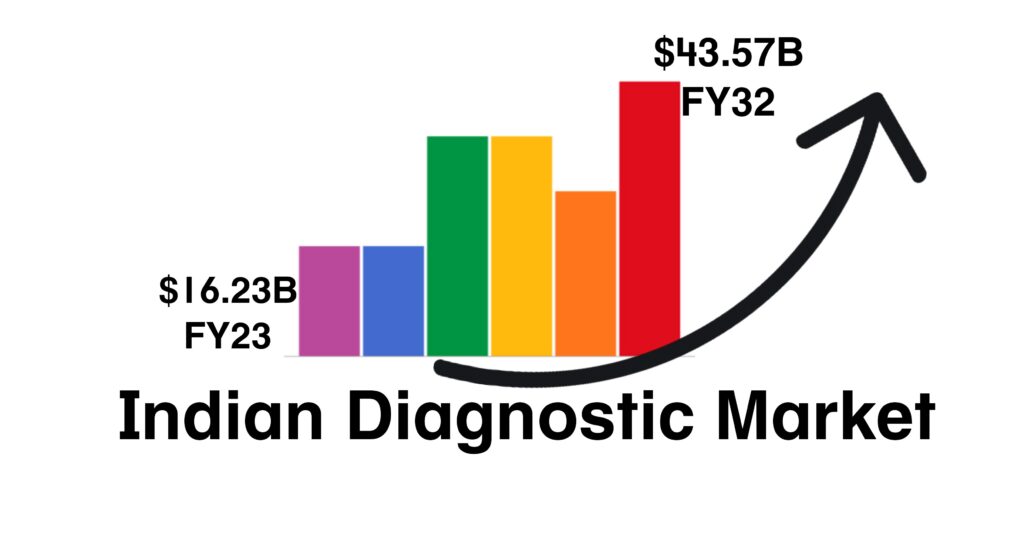

The diagnostic companies clearly registering gtowth and market size is even becoming bigger for diagnostic stocks as new players are also entering into diagnosis segment.

Growth factors of Diagnostics Stocks:

1. Branded diagnostics Centers are continuously increasing their market share by acquiring local chains

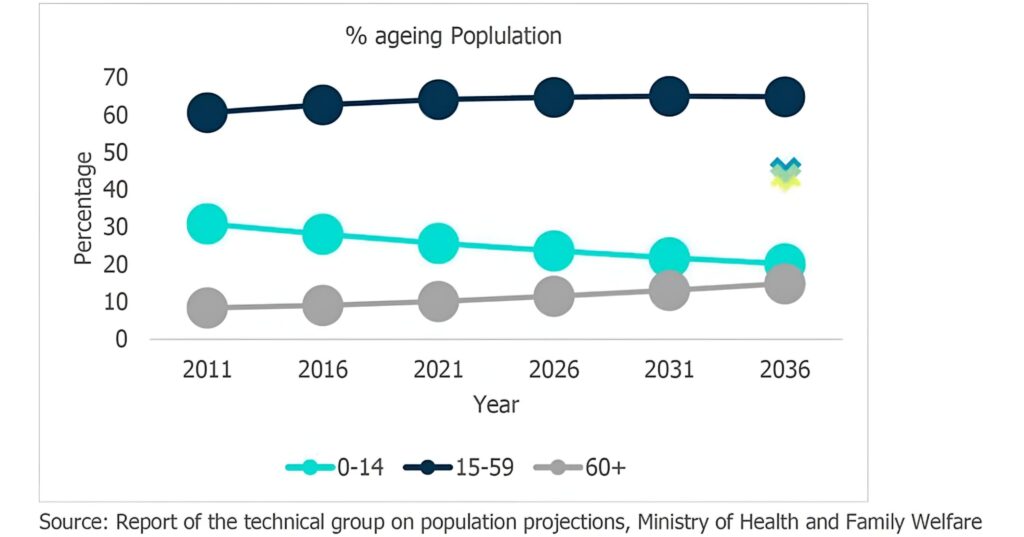

2. The size of preventive tests and it’s volumes is gradually growing

3. The awareness and the importance of pre-medical tests has been increased

4. Mainly the per capita income is growing in our country, so people are showing interest towards spending on health and it’s preventive measures.

5. People are regularily visiting the diagnostics stocks/centers as health insurance penetrating gradually.

6. The branded diagnostics stocks/centers are heavily tying up with local doctors as they wont accept other centers reports.

7. The big changes in lifestyle has been leading to the several health issues, which is again big opportunity and growth factors to the both hospitals and diagnostics stocks.

Risks of Diagnostics Stocks:

Due to low entry barriers anyone who has money can enter into this business as technology and equipment is almost same. Already Reliance, Torrent Pharma, Medplus and Lupin were entered, if you can see.

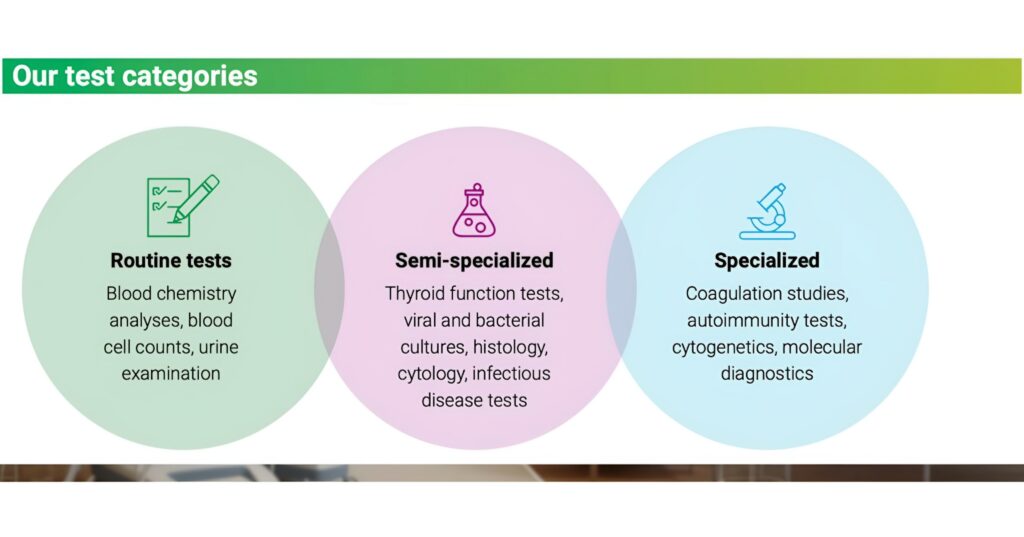

And the small tests would be disrupted by the latest technology as we are seeing lot of small devices are launching by different companies to make tests at home. But remember it’s not possible for complicated and big tests as we already said doctors wont accept the reports from other centers.

So if you observe all those above points, they will give you the clear image about the growth of Diagnostics stocks and it’s industry. Now we look into the key stocks that are going to beneficial and their brief analysis.

Multibagger Diagnostics Stocks are here

1. Dr. Lal Path Labs:

This company is the india’s biggest diagnostics chain, mainly based out of north india. this company has 277 clinical lans, 5102 patient service centers and 10,938 pick up points. Overall they had a strong presence across india as they are going to expand their business in south also.

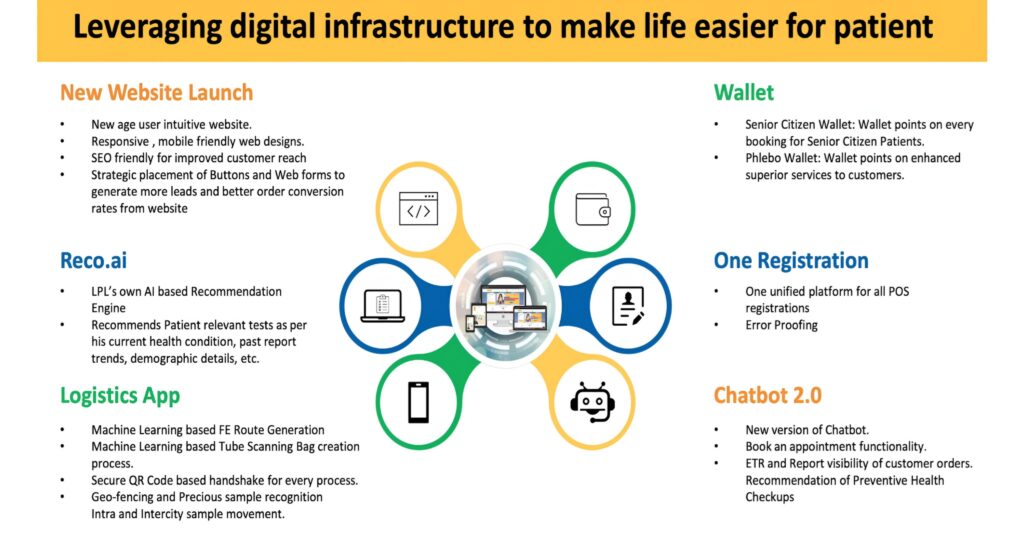

Also focusing on digital side to offer their services digitally as they launched their own chatbot, app and AI based Reco.ai platform, which gives recommendations based on artificial intelligence.

Dr. Lal Path Labs has the strong balance sheet. If you look at debt to equity is 0.14, EBITDA to cash flow ratio is 93% which is a very good and the return ratios are also good, ROCE 18.2%, ROE is 15%. EBITDA margins are 26.10%, which also a good one, which is currently trading at ₹2350.

2. Metropolis Healthcare:

India’s 2nd largest diagnostics stock is metropolis. This company has the strong presence in south side as their majority of revenues are coming from south side only. Though they are strong in south, they had the presence across the country.

If you look at financials debt to equity is 0.22, which is negligible. EBITDA to Cash flow ratios is 86% and generating very good return ratios as their ROCE is 17.4% and ROE is 15.2%. and they are maintaining 23.24% EBITDA margins. Which looks awesome, and currently trading at ₹1830.

But we’ve picked up this stock at very low levels and posted in our Telegram. To join click on Telegram.

3. Vijaya Diagnostic Centre:

Vijaya Diagnostic centre is purely based out of Hyderabad as their 90% of their revenues are coming from Hyderabad itself. Now they are expanding their business in other cities. They have their own listed subsidiary, Medinova Health, which has presence in both Hyderabad and Kolkata.

Also vijaya Diagnostic Centre is trying to expand their business even in inorganic way by acquiring strong local diagnostic stockl/chains. Recently they have acquired PH Diagnostics by spending 147 Cr through it’s cash from balance sheet.

If you look at financials debt to equity is 0.42 and return ratios are, ROCE is 18.4%, ROE is 16.6% and the EBITDA margins are 40.20% which is phenomenal, which is currently trading at ₹678

4. Thyrocare:

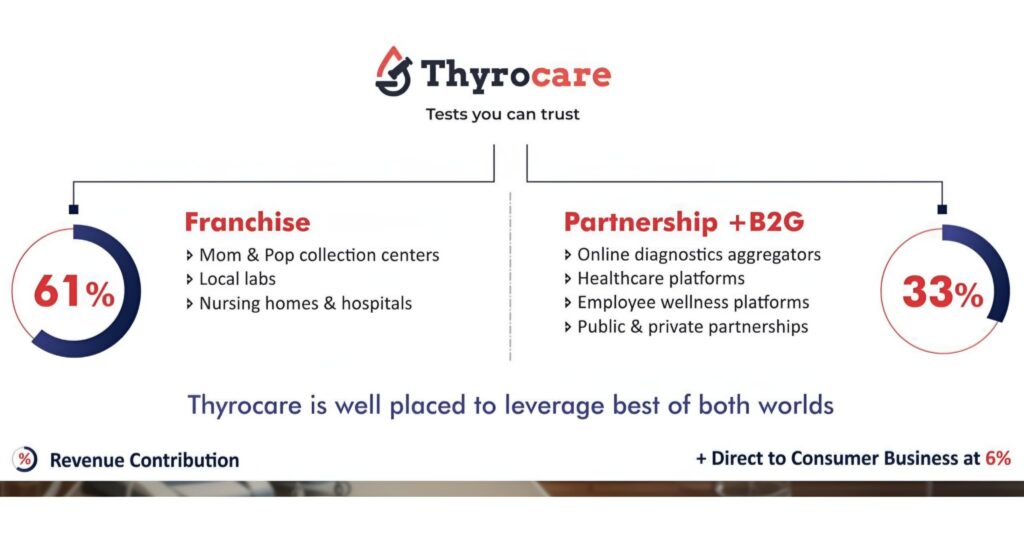

Thyrocare is also a well known indian diagnostics stocks as they strong prensence across the country. This company operates their business through the franchise model. They have 7400+ franchises across the country. During covid this company has been acquired by PharmEasy, that’s why stock is falling as they pledged 99% stake as they are loss making business.

If you look at financials the debt to equity is 0.09 and the return ratios are ROCE is 15.3%, ROE is 10.6% and the EBITDA margins are 28%. Which is also a good. Thyrocare is also having a strong balance sheet and this diagnostics stock is currently trading at 645.

5. Krsnaa Diagnostics:

Krsnaa Diagnostics business model is completely different from others as Krsnaa operates and generates most of their revenues from the government as they set up their centers in government hospitals by winning tenders.

Krsnaa Diagnostics is also having a strong balance sheet and financial like other diagnostics stocks and this stock is currently trading at 575.

Also you can play this theme indirectly by

6. Tarsons Products

Tarsons products is the key supplier of the machinery and the large equipment which the diagnostics stocks needed. This company is also having very strong balance sheet and the ebitda margins are awesome. Which is currently trading at 463.

You can also have a look at these 2 hospital stocks as they started their own diagnostic centres. These 2 hospital stocks as they started their own diagnostic centres,

7. Fortis Healthcare – ₹437

8. Apollo Hospitals – ₹5970

these 2 hospital stocks as they started their own diagnostic centres, but I don’t think this would impact diagnostics stocks. Remember due to only growth in market size and by increasing their share, these companies will grow in long term.

Conclusion:

Hope this analysis helped you as we discussed the overall Diagnostics stocks, diagnostic industry, growth factors and the key stocks we have in the industry. Clearly some big decadal opportunity is coming in the diagnostic stocks.

Already we’ve picked up, which delivered multi fold returns in the past few months. Have a look