This industry plays a vital role in the human life from birth to death, also this industries products are one of the basic needs of our lives, this industry is nothing but textiles industry. Nowadays a days everyone decides us by what we wear. The textile industry has undergone the pressure due to several reasons such as the Euro zone crisis, recession fears and hike of cotton prices. Now things are going to play positively for this industry in india.

In this article we have avoided the domestic players of the textiles Industry as there is huge opportunity opened for the companies who exports their textiles to the Eurozone and USA. We’ll discuss about top 10 companies in the textile industry from india.

Major Advantages that textiles industry has:

- China +1 strategy is playing a key role

- Ban on Xinjang’s cotton and related products from china, which is producing more than 20% in the global share.

- The Central government is pushing this industry to go forward and manking policies accordingly.

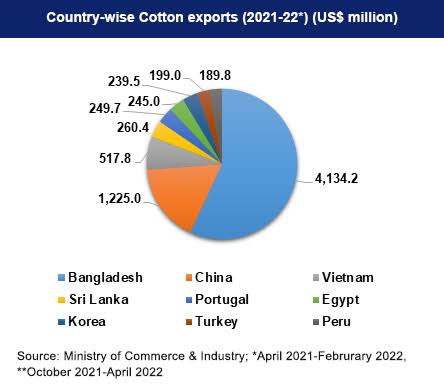

- India has the biggest raw material advantage as our nation is the second largest exporter of the Cotton.

- Already we have a tax advantage in USA in home textiles segment.

- If we get tax advantage from Eurozone that would be the another biggest positive as already talks are going in between the governments.

Key Risks that the textiles industry has:

- Low market capitalization as all the companies are small there would be lof to volatility.

- The textile industry is the labor intensive industry.

- We always should trach the cotton prices as cotton is the most important raw material for this industry.

- Capex is always a challenge for this industry.

- Should closely track the government policies.

- Geographical challenges would be there, because if any crisis is there in the Eurozone and UK, that mist effects the company which has the major exposure to the Eurozone.

Before diving into the companies, my strong suggestion is to invest in all the 10 companies would be beneficial instead of investing into any single stock or favourite stock as this textile industry will have a big volatility, also we don’t know which company gets better orders, which company is going to get beneficial from this scenario or current situation.

Top 10 stocks to look into it:

1. Gokaldas Exports Ltd

Gokaldas Exports Ltd is a textiles exports company which majorly exports adults fashion to the other countries, it exports 84% to the north america. This company has healthy ratios and generating positive cash flows. Most of DII’s are holding this company in their portfolio. If you look at client base, Adidas, Reebok, Puma, H & M, GAP, Fitch and many more international popular brands are the clients of this company. Gokaldas Exports currently trading at 393.

2. SP Apparels Ltd

SP apparels ltd is a pioneer in the kids apparel industry, it has already a good exposure to the European zone. This company generating healthy return ratios and positive cash flows. SP apparels is currently trading at 404.

3. Kitex Garments Ltd

Kitex Garments Ltd also an exporter of kids garments, generating positive cash flows and healthy return ratios. This company currently trading ar 158.

4. KPR Mills Ltd

KPR Mills Ltd is also a good company to play with this exports theme. Generating positive cah flows and healthy return ratios as well. KPR Mills is also having most popular international brands as a clients such as Decathlon and etc. this company currently trading at 575.

5. Arvind Ltd

Arvind Ltd continuously growing and increasing their market share In the international markets. This is also a good company to watch out for, and currently trading at 121.

6. Vardhman Textiles Ltd

Vardhman textiles is having the most spindles in India, this is the biggest player in this segment, so we can definitely watch out for this company to add, which is currently trading at 322.

7. Pearl Global Industries Ltd

Pearl global industries is having their capacities in the countries of India, Bangladesh, Vietnam and Indonesia, which are the emerging markets for textile industry. So that would be big positive factor for this company, currently trading at 505.

8. Lakshmi Machine Works Ltd

Lakshmi machine works is not a direct textiles company but if textiles industry grows, this company would get benefitted from the textiles industry growth. Voltas is also a partner of this company. If anyone can play indirectly play with this company by not taking direct risk. This company currently trading at 11620.

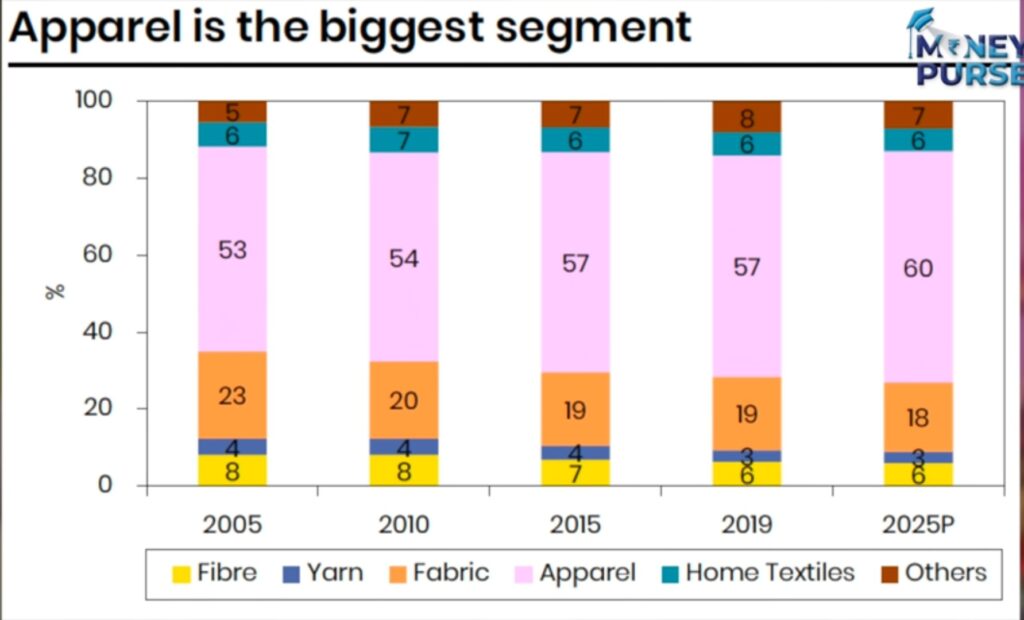

The above seven companies are mainly focused on apparel segment which our key focus area, but the remaining three companies are related to home textiles, which are already having good market share and strong presence in international markets. They are as follows

9. Welspun India Ltd currently trading at 93

10. Indo Count Industries Ltd currently trading at 159

11. Himatsingka Seide Ltd currently trading at 89

Conclusion:

To play with this theme, I would strongly recommend to invest all the above companies by allocating some capital instead of investing into any single stock as textile industry is highly volatile and that to we are going to play with only exports theme. So better invest in all the companies as we don’t know which company gets big orders and which company is going to grab the opportunity. And finally it’s my personal observation and analysis, before inesting any single stock, better consult your financial advisor.