Only one company in India and very few in the world. This company is the chemical monopoly company as this company doesn’t have any competition and there is almost no chances to the other companies to enter into this business as government will not be given any licenses to enter into this particular segment. This company generating 36% of margins and enjoying the monopoly status and the company name is Paushak Ltd. Will discuss all the things in detail.

Paushak Ltd is an Alembic group of company and India’s largest phosgene derivatives manufacturer and manufactures phosgene gas based derivatives which will be widely used in agro chemicals such as fertilizers, pharmaceuticals such as APIs which is essential in pharm industry. The key products of this company are Isocyanades, chloroformates and carbonyl chlorides.

Why Paushak, The chemical monopoly company?

Understand Phosgene Gas:

The Phosgene gas was very dangerous gas as this gas was highly toxic and poisonous, as this gas has enough capability to kill the humans as it was earlier used by Germans against France in the world war 1. As reports says around 85000 people were died by this gas derivatives inhalation in various incidents. We also witnessed the consequences of this gas derivatives in the Bhopal Gas tragedy. So you people understand, how dangerous this gas and it’s derivatives are.

Necessity of Phosgene:

Then we’ll try to understand the necessity of manufacturing phosgene. Phosgene gas derivatives widely uses in the production of pesticides, in the production of polymers, in the production of APIs (Pharma) and uses phosgene as a key purification element in various chemical processes and some ore separations.

Intro of Paushak Ltd:

Paushak Ltd is the only company which has the regulatory approvals to sell the phosgene gas derivatives, though there is other manufacturers of phosgene such as GNFC, UPL, BASF and Atul, but these companies doesn’t have selling rights,they only produces for their captive consumption as they manufacture pesticides.

There is strong regulatory guidelines which doesn’t allow other companies to manufacture as it’s very dangerous and company should be taken a vast protective measures to handle these gases, but the Paushak is doing this work since 43 years without any remark. These all points come together establishing Paushak Ltd as the chemical monopoly company.

Product Portfolio:

| PRODUCT | CAS NO. |

|---|---|

CHLOROFORMATES |

|

| Benzyl Chloroformate | 501-53-1 |

| Ethyl Chloroformate | 541-41-3 |

| Methyl Chloroformate | 79-22-1 |

| Phenyl Chloroformate | 1885-14-9 |

Isobutyl Chloroformate |

543-27-1 |

| N-Pentyl Chloroformate | 638-41-5 |

| N-Hexyl Chloroformate | 6092-54-2 |

| 2-Ethylhexyl Chloroformate | 24468-13-1 |

| Cetyl Chloroformate | 26272-90-2 |

| Myristyl Chloroformate | 56677-60-2 |

| Tert-Butyl Cyclohexyl Chloroformate | 42125-46-2 |

| Secondary Butyl Chloroformate | 17462-58-7 |

| Para Nitrophenyl Chloroformate | 7693-46-1 |

| Allyl Chloroformate | 2937-50-0 |

| Menthyl Chloroformate | 7635-54-3 |

| Octyl Chloroformate | 7452-59-7 |

| 1-Heptyl Chloroformate | 33758-34-8 |

| 2-Ethyl-1-Butyl Chloroformate | 58906-64-2 |

| Propyl Chloroformate | 109-61-5 |

| Vinyl Chloroformate | 5130-24-5 |

ISOCYANATES |

|

| 2-Chloro Ethyl Isocyanate | 1943-83-5 |

| 2-Chloro Phenyl Isocyante | 3320-83-0 |

| 2-Phenyl Ethyl Isocyanate | 1943-82-4 |

| 3,4-Di Chlorophenyl Isocyanate | 102-36-3 |

| 3,5-Di Chlorophenyl Isocyanate | 34893-92-0 |

| 3-Chlorophenyl Isocyanate | 2909-38-8 |

| 4-Chlorophenyl Isocyanate | 104-12-1 |

| 4-Chloro-3-(trifluoromethyl) Phenyl Isocynate | 327-78-6 |

| 4-Isobutoxybenzyl Isocyanate | 639863-75-5 |

Cyclohexyl Isocyanate |

3173-53-3 |

| Isopropyl Isocyanate | 1795-48-8 |

| N-Butyl Isocyante | 111-36-4 |

| o- Toluidine | 614-86-6 |

| Phenyl Isocyanate | 103-71-9 |

| P-Toluenesulfonyl Isocyanate | 4083-64-1 |

| Stearyl Isocyanate | 112-96-9 |

| Tert- Butyl Isocyanate | 1609-86-5 |

| Trans-4-Methyl Cyclohexyl Isocyanate | 32175-00-1 |

| CHLORIDES | |

| 3 Chloropropionyl Chloride | 625-36-5 |

| 4 Chloro Butyryl Chloride | 4635-59-0 |

| 5 Chlorovaleroyl Chloride | 1575-61-7 |

| Diethyl Carbamoyl Chloride | 88-10-8 |

| Dimethyl Carbamoyl Chloride | 79-44-7 |

| Diphenyl Carbamoyl Chloride | 83-01-2 |

| N,N Bis(2-chloroethyl)carbamoyl Chloride | 2998-56-3 |

| N-Ethyl-N-Methylcarbamoyl Chloride | 42252-34-6 |

| N Methyl Piperazine Carbamoyl Chloride Hydrochloride | 55112-42-0 |

| N Methyl-N-(phenylmethyl)-Carbamoyl Chloride | 32366-02-2 |

| CARBONATE / CARBAMATE | |

| Chloromethyl Isopropyl Carbonate | 35180-01-9 |

| Bis-(4 Nitrophenyl) Carbonate | 5070-13-3 |

| 2-Methacryloxyethyl Vinyl Carbonate | 145497-35-4 |

| Polyquaternium | 75345-27-6 |

| N-Butyl Propargyl Carbamate | 76114-73-3 |

| 3-Iodo 2 propynyl N-butyl Carbamate | 55406-53-6 |

| 3-[Tris(trimethylsiloxy)silyl]propyl Vinyl Carbamate | 134072-99-4 |

OTHERS |

|

| Tetrabutyl Urea | 4559-86-8 |

| 2-Thiophenecarboxaldehyde | 98-03-3 |

| Vilsmeier Reagent | 3724-43-4 |

| 5-Methoxy-1,3,4-Thiadiazol-2(3H)-One | 17605-27-5 |

| 4,5-Dimethyl-1,3-Dioxolen-2-One | 37830-90-3 |

| 4-Chloromethyl-5-methyl-1,3-dioxol-2-one | 80841-78-7 |

| 4-(Hydroxymethyl)-5-methyl-1,3-dioxol-2-one | 91526-18-0 |

| 3,4,4-Trichlorocarbanilide | 101-20-2 |

| 2-Methyl-2-propyl-1,3-Propanediol Dichlocarbamate | 80471-57-4 |

| N-[1-(S)-Ethoxycarbonyl-3-Phenylpropyl]-N-Carboxy-L-Alanine Anhydride | 84793-24-8 |

| 3-Isopropyl-4-amino-1,2,4-triazol-5-one | 96240-10-7 |

| Dibenzyl Azodicarboxylate | 2449-05-0 |

| Dicyclohexyl Carbodiimide | 538-75-0 |

| N,N’ Carbonyldiimidazole | 530-62-1 |

| 2-Chloro-Dibenzo-[b,f][1,4]thiazepin-11(10H)-one | 31590-04-4 |

| Trimethylamine-sulfur Trioxide Complex | |

You can also check here the complete product portfolio from paushak ltd’s official website.

Key growth drivers:

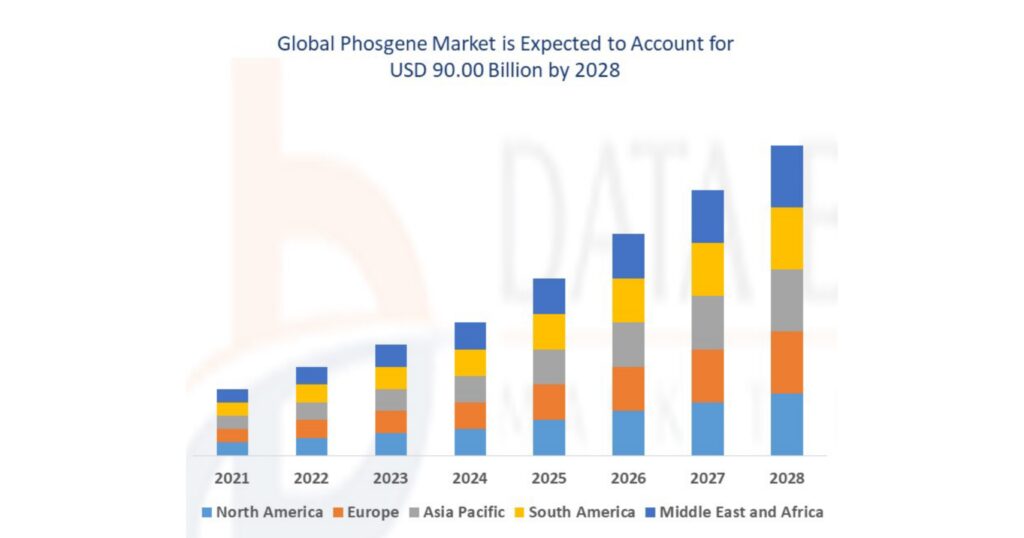

1. Industry size is gradually increasing and expected to be reached 90 billion dollars by 2028.

2. Polymers demand is gradually increasing in india as our nation turning to become a manufacturing hub. Due to make in india program lot of companies are manufacturing here and as our country banned the imports of laptops and other electronics, they all are going to manufacture here. As we know already Apple started manufacturing their Iphone 15 series phones in India.

3. Paushak ltd already received the environmental clearance to manufacture APIs, which can boost the revenues and profitability.

4. The company also entering into the CRAMS business as this segment has the high margins.

5. Paushak Ltd has strong moat in the business and the competitive edge.

6. Also working on to export the phosgene derivatives and in discussions with the international clients.

7. As confirmed by the management the company’s capacity extended from 4800 MTPA to 14,400 MTPA and started production.

8. Strong regulatory guidelines are entry barriers for other companies.

9. This company has no dependency on any other country in view of raw material or supply chain and clients as this company plays domestically because we already discussed that we can’t store this gas too much.

Risks to be observed:

1. As this company producing the dangerous products, if anything goes wrong, the damage will be huge.

2. As we discussed in the growth drivers the company has been started producing lot of other downstream products of phosgene which will impact the margins.

3. Company is trading at little higher valuations though it’s trading at good demand zone.

4. Company management is not the shareholder friendly.

Financials:

Paushak Ltd is the strong company both fundamentally and financially as this company has the strong moat in business and competitive edge in view of fundamentals and has the rich cash flows, healthy return ratios & debt free books in view of financials. If you look at the shareholding pattern promoters are the majority shareholder, having 67% of the stake.

Paushak Ltd is currently trading at 6774 and the ₹6500 is the very good buying zone.

Conclusion:

Though the stock is trading at little higher valuations, we can accumulate this stock as this company has strong moat in the business and competitive edge, which are ensuring this company as the chemical monopoly company. As we discussed if any fall down in margins, we can see some correction in the company, that would be the better opportunity to accumulate more.

Note: Kindly approach your financial advisor before investing into any stock, as the views and analysis sharing here are purely based on my personal view and we are not SEBI registered.