DRONE, the five letter word, which is taking place everywhere across the world. If you can see, drones are playing very much interesting role across the industries such as mining, defence, construction, oil and many more. Now a days we are witnessing the drones in our daily life, like in marriage functions to capture the photos and videos and also witnessing in major global event such as Russia and Ukraine war. Though there is significant difference between personal life drones, commercial drones and defence drones, but they are playing a vital and essential roles across the industries as we discussed earlier.

If we dive into the Ideaforge IPO, ideaforge is the India’s largest drone manufacturer and this company is holding the 50% of the market share in india. Also ideaforge is having 25 patents handy, which is positive for this company as there is lot of entrants in this industry. Ideaforge is largest drone supplier to the indian defence.

How many of you remembered the 3 idiots movie and the drone scene, that drone which was manufactured by the same company ideaforge. From there company has started their impressive and inspirational journey towards their IPO by attracting the tech giants as their investors such as Infosys, Qualcomm. Ideaforge manufactured the thinnest and light weight drone.

Key growth drivers of Ideaforge:

- In view of reducing cost of labor and for better quality work, companies are adopting the drones, especially this culture is coming in startups.

- Drone adoption rapidly increasing across the industries.

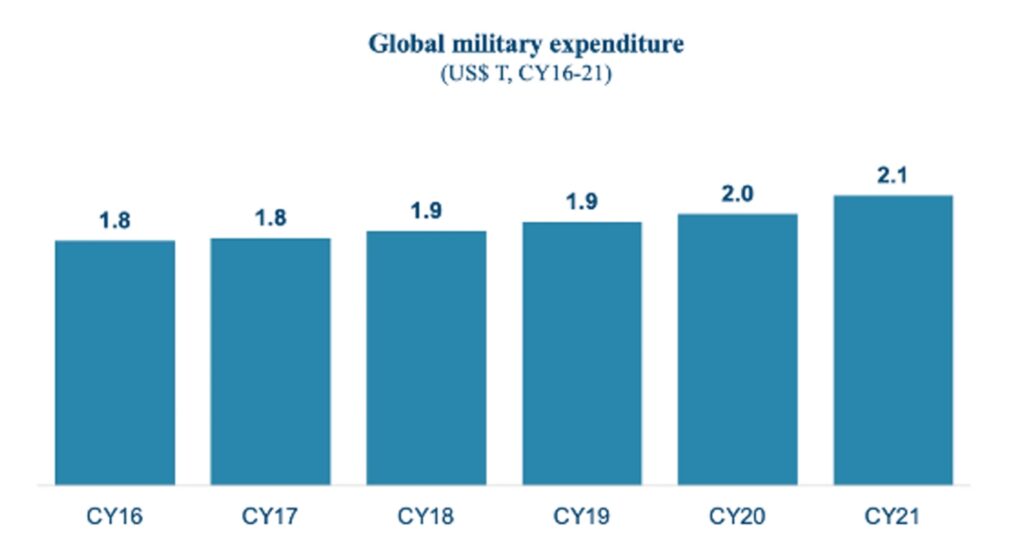

- Drones are playing very decisive roles in defence, also we are witnessing the recent war incidents.

- Indian government brought a great policies towards encouraging drone industry.

- Drone based startups and companies are continuously growing, and entire eco system turning positive towards drones and their manufacturerers.

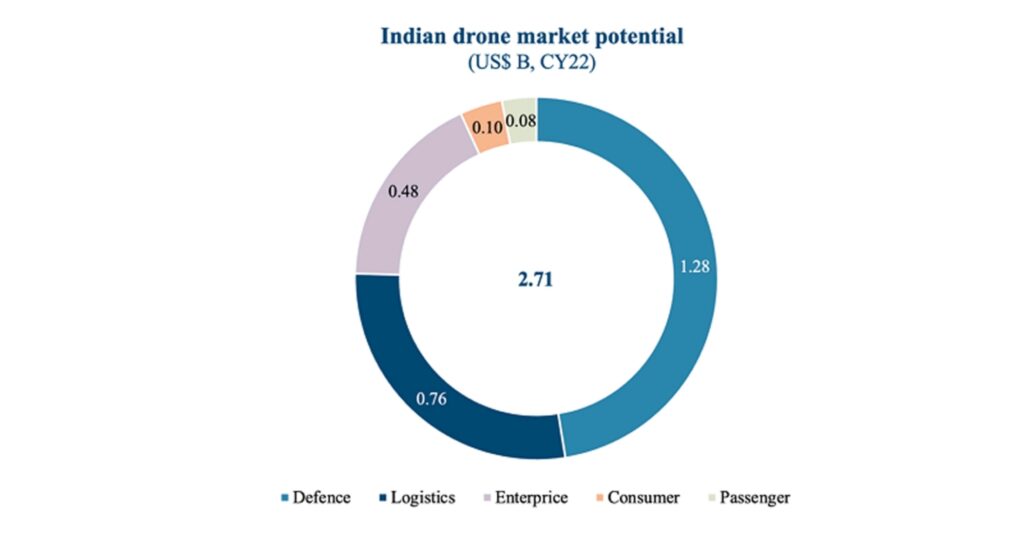

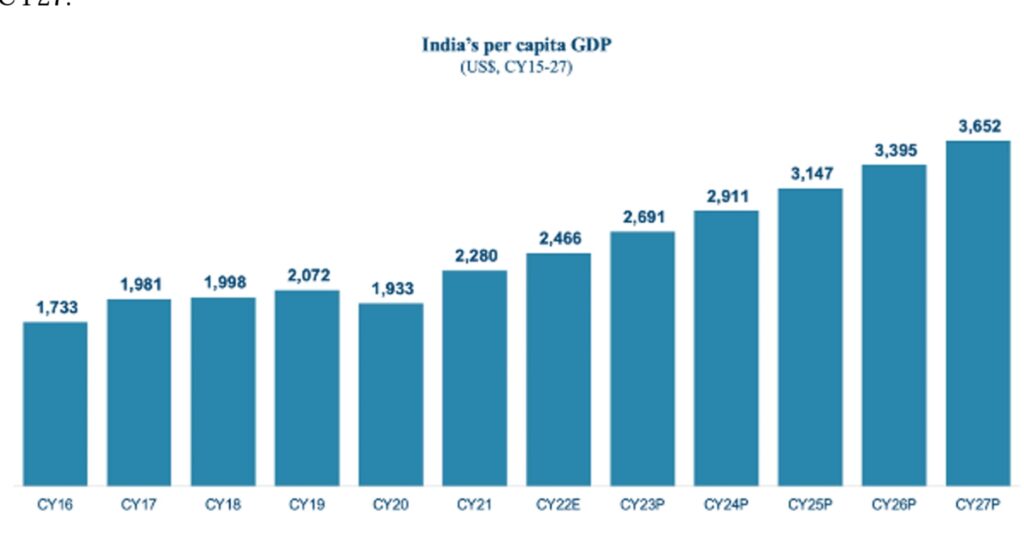

- Drone market size is gradually growing, such a big way both domestically and internationally as your can see it very clearly in the below pictures.

Drone adoption in industries:

Now a days every industry adopting the drones from small youtuber to defence, everywhere we are witnessting the drones. The below picture will give you the clear view about the industries, which have been adopted the drones and their use cases. This scenario wll definitely will positive for ideaforge ipo.

Key Risks for Ideaforge:

- The changes of government polices may severely effects this industry.

- As there is no big entry barrier, lot of new entrants will come into the game.

- Recent drone blast may play negative, if such cases increases

- Working capital cycle is too long, as per RHP it’s 190 to 200 days as their big customer is Indian government and Indian defence.

- Still there is no clarity in margins, where they can stable.

Ideaforge Financials:

As per the RHP data company’s revenues are significantly grown from 34 to 186 crores in the period of 2021 to 2023. This company posting profits from the last couple of years as it was the loss making company initially. Also there is no stability in margins. As they mentioned due to big employees allowances there is some effect in PAT in 2022.

Ideaforge is having a debt and they are going to clear it post IPO. They are also coming with attractive PE multiples compare to their peer companies which are trading expensively than ideaforge. If it plays positive market may give good PE re rating.

Ideaforge IPO details:

| Issue type | Book building |

| Issue size | 567 Cr |

| Fresh issue | 240 Cr |

| Offer for sale (OFS) | 327 Cr |

| Face value | 10 |

| Price range | 638 – 672 |

| Lot size | 22 |

| Minimum (1 Lot) | Rs. 14784 |

| Maximum (13 Lots) | 192192 |

| Listing exhanges | BSE & NSE |

Important Dates:

| Issue opens on | 26/06/23 |

| Issue closes on | 29/06/23 |

| Allotment date | 04/07/23 |

| Refund | 05/07/23 |

| Shares credits to Demat on | 06/07/23 |

| Open for trading | 07/07/23 |

If you can see there is only 10% is for retail people, the following are the details about allotment proportion of IPO of Ideaforge.

QIB – 75%

NII – 15%

Retail – 10%

Grey Market Premium:

As of now subscribers are still ready to buy ideaforge shares 70% – 100% higher than actual IPO price in the open market.

Conclusion – Apply or Avoid:

As there is lot of buzz in the market about the company as it’s doing the trending business and the peers trading at the expensive valuations and all other growth drivers and the government policies and everything playing positively. So we are applying to the IPO, but not sure whether allotment will come or not as there is only 10% of portion is there for retail people.

Short term – POSITIVE

Medium term – POSITIVE

Long term – will update after seeing industry’s establishment and the company stabilization as we are at early stages of drone evolution, still needs to be watch the upcoming the trends and establishment. As we are expecting good momentum in short term, if not clear even after some time will exit by playing the short term momentum.

Disclaimer: As i am not a SEBI registered advisor, kindly consult your financial advisor before taking any investment decision