Will really Gold prices touches ₹100000 soon? Here is the complete story…

Gold is India’s most favorite metal as there is too much importance in Indian culture. Gold has significantly strong routes in Indian history also gold becomes the part of Indian history from ancient times. For Indians gold is more than an investment. Also India is the most consuming country of gold globally.

While coming to the investment part, now a day everyone is talking about gold that gold will touch 1L and above in coming years, yes of course gold price will be increased in coming years. That’s for sure. But, firstly we need to understand the price behavior of gold in the past decades, if you understand this properly you can make money through gold investments. Whenever there is uncertainty in equity markets, the money will flows into the gold, which is everyone sees gold as a safe investment.

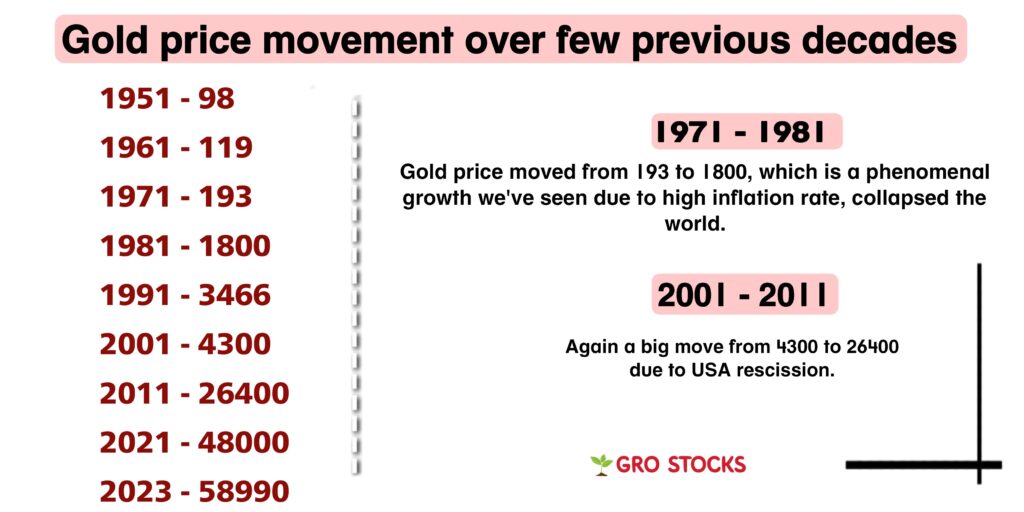

You can find the gold performance from last few decades here.

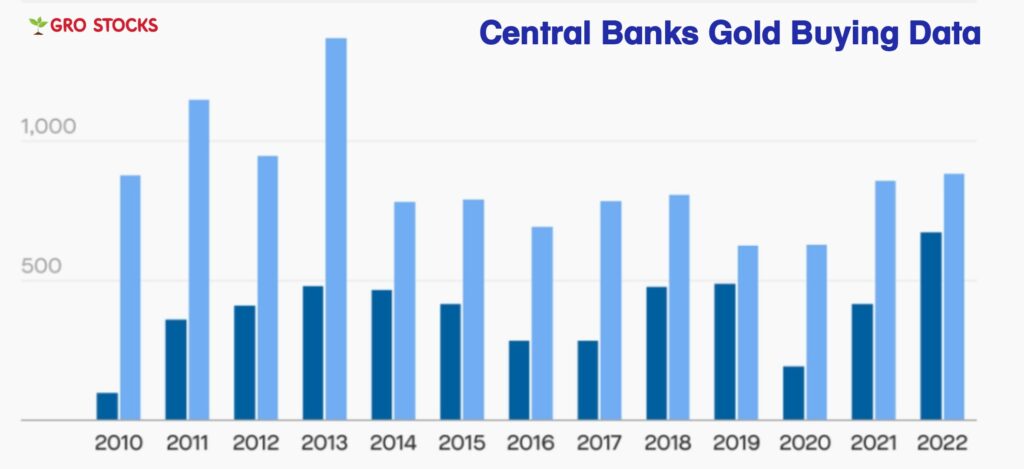

If you observe above data, it’ll clearly shows that gold prices increase while there is uncertainties globally such as high inflation rate, global rescission and Covid. 1970 – 1980 and 2000 – 2010, these two decades witnessed significant growth in gold price. Also you can see one more data point that central banks aggressively buying gold as entire world expecting rescission from USA and UK.

Major reasons to increase the gold price:

- Highest Inflation rate will always leads to up move in gold price

- In all rescission kind of scenarios gold prices will increases. Past data also showing the same.

- Uncertainty of equity markets causes to gold price up move.

- Central Banks will buy huge gold in unstable conditions to increase their reserves.

- Fall of US Dollar price is also a reason for gold price increase.

Gold Investment Options:

1. Physical Gold: (Not Recommended)

Physical Gold is one of the gold investment option, which is not recommendable for the investors as we lose the depreciation charges, making charges, and other taxes on jewellery and on gold ornaments. Also there will be lot of security and storage concerns in further, also there is one more concern that is the ornaments we bought for our children, may not be suitable for them after 10-15 years. If you wish to modify them, then again we lose making charges and depreciation. So we strongly recommend not to invest in the physical gold.

2. Digital Gold: ( Not Recommended)

Digital Gold is somewhat better than Physical Gold, but still we will not recommend to invest in Digital Gold as we lose almost 6% of GST on buying and selling the digital gold. If you observe there will be 3% GST on buying and abother 3% on selling digital gold. Though it is looking easier to invest in gold, it’s not recommendable to invest until unless you are trading with gold.

3. Sovereign Gold Bonds:

Sovereign Gold Bonds are ultimate alternative for physical gold. Also we strongly recommend to invest in sovereign gold bonds if you are lokking for long term as this investment will have a lock in for next 7 years. Apart from gold price increment, you will also get assured 2.5% of interest every year. SGBs are secured investments as its offered by Reserve Bank of India. In SGBs there will be no capital gains tax and GST. If you want to know more about Sovereign Gold Bonds will soon publish an article with full details.

4. Gold ETFs/Funds:

Whoever not looking for long term, they can invest in Gold ETFs in SIP mode. Gold ETF will be flexible and any time liquidation is possible. ETFs will also help us to accumulate the gold with small amounts over the years. There will be a small fund management charges from fund houses which are negligible compare to having an investment with physical gold.

Conclusion:

As we mentioned above the uncertainty, high inflation rate or rescission kind of scenarios will always leads to the increase in gold price. As current scenario is also looks like the same as USA is going to face rescission in near time, if the rescission will come out then there will be a sharp upmove in the gold. This will continue until the rescission cools off. To catch this price appreciation of gold, we should invest in the gold investment options. As there are multiple options, we strongly recommend to invest in Gold ETFs and Sovereign Gold Bonds. If you are looking for long term then SGBs are good option else we can go with ETFs.