Only one event which completely changed the entire global thought process of the every country’s defence and their standards, where exactly they stand out. That one event is Russia – Ukraine war, it’s changed entire world’s stand and this event ensured that still there is chances of wars between the countries. In view of this war uncertainties every country is looking forward to expand their defence budgets.

Also we should observe that world is moving from unipolar to bipolar which means that the world is moving out from dictatorship as every individual country taking their decision on their own which helps to their countries. To sustain in such system individual countries must increase their defence to protect their country and their ideology.

Growth factors of defence sector in India:

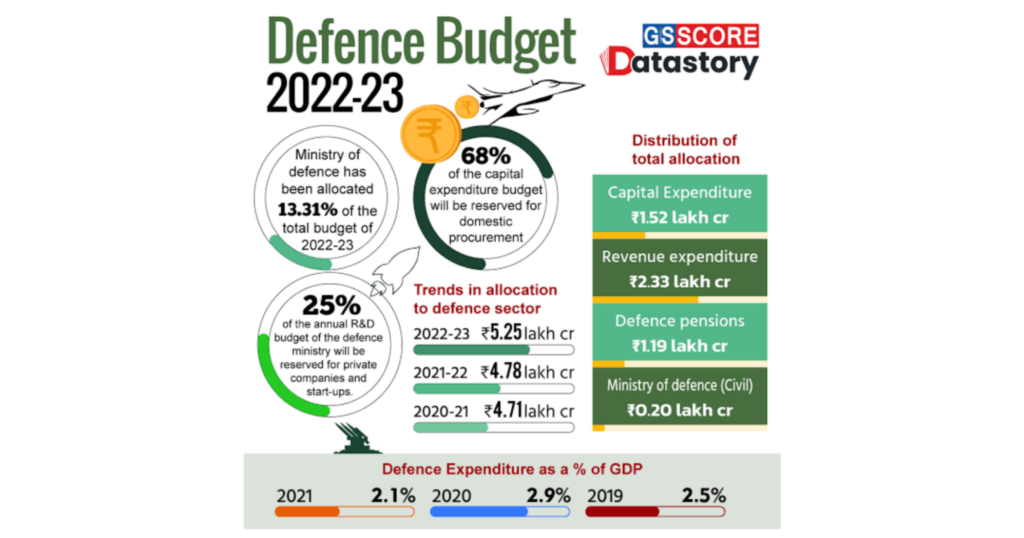

- As Indian economy is growing, there must be growth in GDP. Along with GDP growth the country also will increase the allocation of defence budget. We can see the clear uptrend in defence budget allocation, this trend will remain continues.

- India started and successfully established the Atmanirbhar Bharat campaign in view of making the country self-reliant. It’s also applicable for defence sector which enables to made defence equipment on our own.

- Government of India allowed private partnerships to boost defence equipment manufacturing, which will helps private players to participate this growth in defence.

- Government of India also allowed foreign direct investment up to 74% in defence sector.

- If you compare the indian made defence equipment is much cheaper than US made defence equipment but effective in the performance.

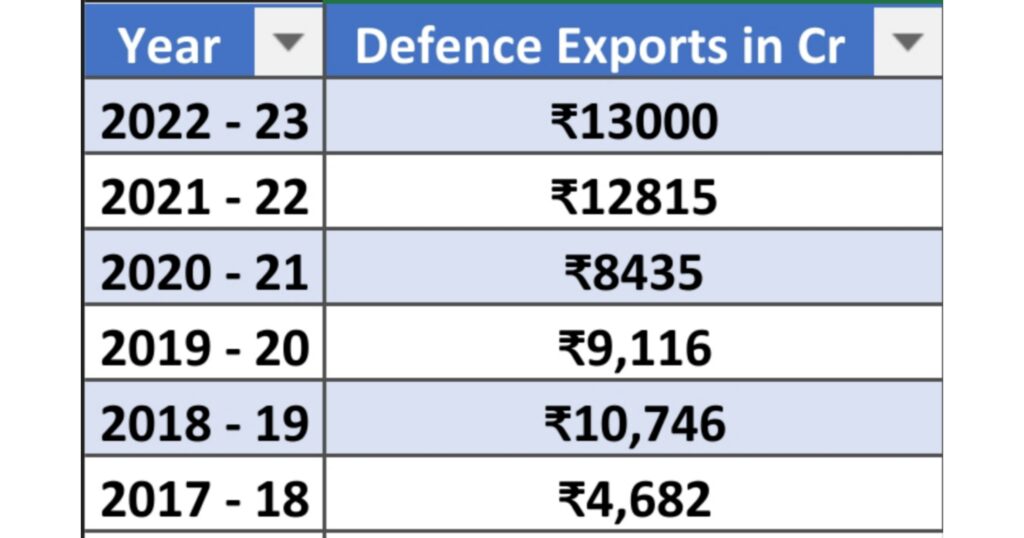

- Defence exports are continuously growing as our nation won the global trust as we are making trust worthy, effective and cost effective products.

- Almost 928 defence products were banned by Indian government to do not import from other countries. Which is the biggest booster for indian manufacturers.

- Indian defence products are very much compatible for small countries as they are cost effective and better in performance. You can also compare the Boeing Apache Helecopter and HAL’s Prachand Here.

Key Risks Defence sector:

- Government regulations are the major risk for this sector as clients of this sector is other country’s governments. If any govt regulations changes, that would effect the numbers in a big way.

- If you observe the defence companies there would be biggest volatility in their numbers, so must understand this volatility before investing in defence stocks.

- As demand is rapidly increasing, lot of new companies will come into the picture to cater and to meet the demand. In that case the margins will be lower.

- If margins impacts, automatically it may reflects in the profitability and impacts the overall numbers of the company. So we should avoid such type of companies which doesn’t have entry barriers.

- If orders getting cancelled due to any reason or uncertainty, it might impacts the particular company’s numbers as usually defence companies receiveives big orders from the governments.

We’ve clearly discussed the growth drivers and the key risks which may impacts the defence sector. As we got some idea about the industry let’s dive into the hidden multibagger stocks of defence sector which doesn’t have buzz in the market but had the potentialtential to deliver multifold returns.

If you look at the big names in the industry such as Mahindra, TATA, Aditya Birla, L&T, Cyient and others are the companies which has the small exposure towards defence sector. If we search for defence companies in the google, it will shows these names only but the fact is the companies are having low exposure which cannot impact their profitability and margins. So we should avoid these stocks.

Now one more segment we should avoid that is PSU defence stocks which are the biggest beneficiaries of the defence sector growth. But we are avoiding these stocks also as they are already moved in a big way. So better we should avoid the companies such as HAL, Bharat Dynamics, Bharat Electronics, BEML, Midhani. Invsting in such higher levels will not give us enough confidence and conmort to hold the stocks.

Now we discuss the hidden gems which are capable enough to deliver multifold returns though one among those company don’t have good ratios, still big AMCs are holding these companies and one more thing that DIIs are gradually increasing their stake in the below stocks. Let’s dive in

Hidden Gems of Defence sector:

1. MTAR Technologies Ltd

MTAR Technologies Ltd is a company which manufactures different types of machine equipments and assembles defence equipments. They have their operations Nuclear, Aerospace & defence, Clear energy and other product manufacturing such as high precision systems, metal sheets and many more. This company supplied engines for PSLV and GSLV engines for ISRO. GSLV engine which was used in Chandrayan 2. MTAR is currently trading at ₹1920.

2. Paras Defence & Space Technologies Ltd

Paras defence is providing their services in designing, developing, manufacturing and testing of variety of defence and space engineering products, this company is also working towards drones for defence. We have been provided in depth analysis of MTAR in IPO video, you can Check Here. This stock is currently trading at ₹618.

3. Data Patterns India Ltd

This company has the vast designing capabilities across the defence, space and sea. This company itself designed the HAL’s Prachand (LHC) and Dhruv and also this company has been associated in making of Brahmos missiles. This stock is currently trading at ₹1871.

4. Solar Industries India Ltd

Solar industries is worlds leading manufacturer of explosives, which can be used in defence, mining and Industries. Almost we can say this company as monopoly in bulk explosives and it’s associated machines, this company also manufactures initiating systems and trading at ₹3840.

5. HBL power systems Ltd

As already we know HBL power systems is well knopwn for Kavach systems, but the company actually manufactures the batteries for defence sector. This company manufactures all types of batteries and earning 64% of revenues from this segment. HBL is the world’s second largest manufacturer of Nickel Cadnium batteries in all technologies as this stock is currently trading at ₹153.

6. Axis Cades Technologies Ltd

Axis Cades is entered into defence setcot by acquiring Mistral company also focusing on different other acquisitions which will be helpful to register themselves as a good player in defence sector, also top management was recently joined from TATA group as it’s earlier providing engineering solutions and currently trading at ₹499.

7. Centum Electronics Ltd

Centum Electronics Ltd is also caters defence and aerospace sectors as this company manufactures micro electronics and provides R&D services. If you look at the sharholding pattern HDFC mutual fund is holding this company though they don’t have good fundamentals which is a very good sign and currently trading at ₹1361.

8 Astra Microwave Products Ltd

Astra engaged in providing the design, development and manufacturing of RF and Microwave super components, high value systems and full systems for the defence, aerospace and meteorological sectors. This company’s order book is also very strong. Astra is currently trading at ₹366.

9. Zen Technologies Ltd

Zen Technologies Ltd caters training solutions to the indian armed forces. Also focusing on making indian armed forces self reliant. Zen technologies is the largest player in providing training solutions to the defence sector, and trading at ₹414.

10. Apollo Microsystems Ltd

Apollo Micro systems develops time critical solutions and sells them to the defence as this company majorly works on research and development. This company engaged with Indian defence, DRDO and Brahmos missile programs and currently trading at ₹58.

11. Avantel Ltd

Avantel Ltd actually designs, develops and maintains the wireless communication systems, radar based systems and network management solutions to their customers in the defence and aerospace sectors and currently trading at ₹157.

12. Frog Cellsat Ltd

Frog Cellsat ltd develops and manufactures telecom equipment for defence such as telecom towers, repeaters, in building connectivity, multi band frequency shift repeaters and other equipments and currently trading at 249.

13. PTC Industries Ltd

PTC Industries actually manufactures metal components for critical purposes such as defence, oil and mining. Usually they use Titanium and other types strong steel to manufacture those critical meral equipment. This company recently been tied up with HAL also expanding their capacities to cater the extended demand in defence sector.

14. Dynamatic Technologies Ltd

Dynamatic Technologies Ltd is the largest manufacturer of hydraulic pumps and turbo chargers which caters various industries such as aerospace, defence, automotives and agriculture.

15. DCX Systems Ltd

DCX Systems is India’s leading manufacturer of electronic sub systems of defence & aerospace and cable harness and also this company is the authorized partner for the largest foreign original equipment manufacturers.

Conclusion:

As an industry entire defence sector is going to witness a rapid growth in coming years. Indian current situation is also supporting to the indian manufacturers and exporters. In this situation every stock will ramp up due to this buzz created in defence sector but they will come down after seeing the real numbers. So we have filtered and taken out gems from defence sector. Above 15 stocks are having some technical edge which others don’t have and making these companies unique. So invest wisely and get benefitted out of it. As we are not SEBI registered advisor kindly take a word or suggestion from your financial advisor before investing into any stock as we provided just our personal view.